|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

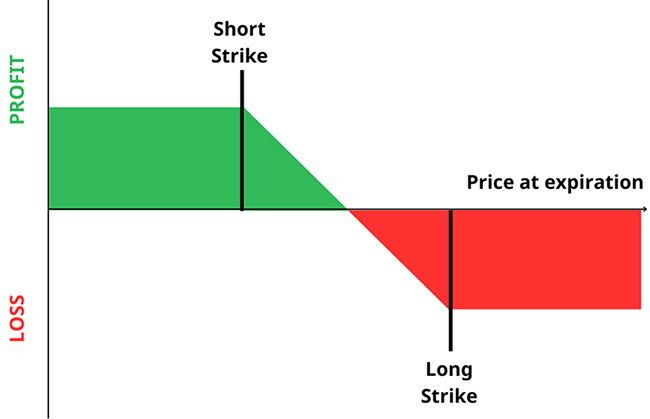

This Simple Options Strategy Could Be Your Secret Weapon in Choppy Markets

Markets have been choppy these past few weeks, and the uncertainty surrounding US tariffs and their long-term implications are forcing investors to the sidelines. But sitting on the sidelines isn’t the only option these days. With options trading, you have an array of strategies that can make money in any market. In volatile, sideways, or slightly bearish markets, strategies like the bear call spread can help investors generate income without needing to predict major market moves. So, let’s talk about how bear call trades work and how you can use Barchart’s new PnL charting tool to your advantage. What Is A Bear Call?A bear call spread is made up of two call options, one long and one short. Call options are contracts that allow the buyer or holder to buy 100 shares of an underlying stock or asset from the seller at a specified price, known as the strike price, within a specified period, known as the expiration date. Options also have a premium attached, which is their value. If you look at an options chain, you’ll find a bid and ask price. The bid price is the maximum price that people are willing to pay, and the ask price is the lowest price that sellers are willing to sell the option for. And since options are based on 100 shares of the underlying, you’ll need to multiply it by 100 to get the contract price. To be clear, when you buy a call option, you buy the right but not the obligation to purchase the underlying. If you sell the option, you agree to sell the shares if the buyer exercises it. A bear call spread is an options strategy that involves selling a call option (also known as a short call) and buying another call option (known as a long call) with a higher strike price, all on the same underlying asset and with the same expiration date. In this setup, the premium you receive from selling the short call is higher than what you paid for the long call, meaning you get a credit right from the get-go. That is what people mean when they say their credit spreads are income-generating strategies. Core MechanicsWith the bear call strategy, there are three points that you’ll want to know: when the trade will hit its maximum profit, its breakeven point, and its maximum loss. Let's say, for example, you sell a call on XYZ stock with a $100 strike price and collect $2 per share. Then, you buy the $105 strike call on the same underlying asset and expiration date, and for that option, you’ll pay $0.50 per share. The maximum profit on a bear call spread is the net credit, and you can calculate it by subtracting the premium paid from the premium received. Then, you multiply it by 100 for every spread you sell. So, in this instance, you’ll receive a dollar fifty, or a hundred fifty dollars per contract for the bear call spread.  Now, the goal of a bear call spread is for the underlying asset to stay below the short strike by expiration. So, that means you’ll want to sell bear calls during neutral to slightly bearish markets. The goal is for the underlying asset to stay below the short strike by the expiration date. In this case, you want XYZ to remain below $100 at expiration. If that happens, both options expire worthless, and you get to keep the premium. If the price of XYZ moves between $100 and $105, then the trade will start to lose value - depending on how close XYZ’s price is to the breakeven point. The breakeven point of a bear call is calculated by adding the net credit received to the short call strike. So, in this case, that’s $101.50. As long as XYZ stays below $101.50 at expiration, you’ll earn at least one cent. Anything above $101.50 and the trade will begin to lose money until the stock hits the long strike. The maximum loss occurs if the stock trades at or above $105 at expiration. You can calculate the Maximum loss by taking the spread width and subtracting the credit, multiplied by 100, for every spread. So that’s $3.50 or $350 per contract. Bear calls can be traded on any time horizon as long as someone is buying and selling options on that specific expiration date. However, for best results, I usually prefer bear calls with 30 to 45 days to expiration (DTE), which gives me more premium compared to shorter-dated options and more time to adjust the trade if necessary. Using Barchart’s Option Screener and PnL Charting ToolNow, let me show you how you can use Barchart’s existing Option Screener tool in conjunction with the new charting tool to enhance your bear call trades. First, access the Bear Call option screener by clicking "Options" at the top of the homepage, then selecting "Bear Call." Once you're there, click on "Screen" to access the filters page. All the filters are default, except for the Probability of Loss filter, which I set to look for trades with a probability of loss below 30%. After running the screen, I arranged the results based on the lowest to highest risk-reward ratios, and now let’s take the first one as an example: According to this (at the time of the screen), you can sell an out-of-the-money, 200-215 bear call spread on AMZN for $3.84 net credit per share, with a maximum loss of $11.16, resulting in a 2.91 to 1 risk/reward ratio. The trade has a 30.0% chance of loss and expires on June 20, 2025. Typically, the process ends there, but you can dive further into the trade details by visiting Amazon’s stock profile page, click on “Vertical Spreads,” then the “Bear Call” tab. You can change the expiration date to June 20 from the drop-down, then enter “200” on the strike field and click “Apply.” The results will generate all AMZN bear call trades with a $200 short strike price. Now, the previous trade is the third one on this list: To further check the trade’s details, click the chart icon beside the expiration date, and the PnL charting tool will appear. The first tab displays the profit/loss chart, along with relevant trade details, as shown on the screener. This is perfect for visualizing your trades before they happen. There are also several other tabs which you can cycle through. The Greeks tab shows the relevant options Greeks for the trade. According to this, the AMZN bear call has a -19 delta, which suggests an approximate 80% chance of the option expiring out of the money. The next tab is Expected Moves, which shows the anticipated range of AMZN’s price movement across several expiration dates, including June 20. According to this, AMZN stock is expected to trade between $207.36 and $170.36 on 06/20/2025. The short strike price is higher than the lower price range, which is ideal, although slightly lower than the higher price range. The next tab, Volatility, shows the implied volatility, historical volatility, and IV rank of the trade, along with IV ranges. And finally, here’s the Trend tab, where price movement expectations are plotted using moving averages across different time horizons. AMZN is expected to move up in the short term and down over the medium and long term, which can validate this bear call trade choice. To further refine your trades, you can also consult the Options Screener tool to filter and look for better ones that fit your trading style and risk profile. Remember to check the full trade details through the PnL charting tool for a broader view of your chances of success. Final ThoughtsBear call spreads are a smart way to generate income in choppy or slightly bearish markets without needing to make big directional bets. With tools like Barchart’s Option Screener and PnL charting, it’s easier than ever to find, evaluate, and manage these trades with confidence. But as always, do your research, stay disciplined, manage your risk carefully, and remember - slow, steady, and informed wins the race. On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|